Consider SBA financing for your restaurant. Strategic financial aid can boost your kitchen business.

Are you an aspiring restaurateur dreaming of expanding from the kitchen to larger success in a new capital? With the Small Business Administration’s (SBA) loan options, you can now turn your dream into reality.

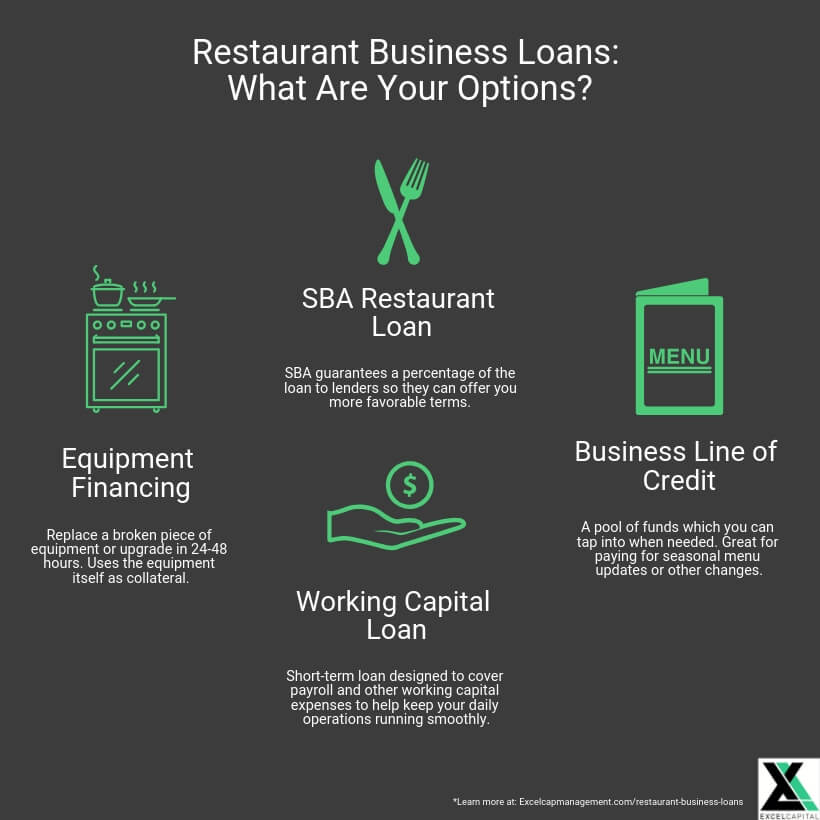

The SBA provides avenues for restaurant owners to access capital to start or expand their business without sacrificing control—from microloans and CDC/504 loans to 7(a) and express loans.

In this blog post, we'll explore the different types of SBA-backed lending solutions available and how you can take advantage of them on your road towards becoming a successful restaurateur.

Start planning each exciting step today with the help of SBA loan weaving its way through kitchens and dreams alike!

Benefits of Taking Out an SBA Loan for Your Restaurant

Running a successful restaurant can be a fulfilling but daunting task and often requires a significant investment of time, effort, and money. Fortunately, there are loan options available to help alleviate some of the financial burden.

An SBA loan is a popular choice for many restaurant owners due to its favorable terms, including low interest rates and longer repayment periods. An SBA loan can be used for a variety of purposes, including purchasing equipment, expanding your business, or even refinancing existing debt.

Beyond the financial benefits, taking out an SBA loan can also provide a sense of security and stability, allowing restaurant owners to focus on their passion for cooking and providing a great dining experience for their customers.

Qualifying Requirements for Obtaining an SBA Loan

Are you an entrepreneur looking for a reliable funding source to kickstart your business plans? Then an SBA loan might be the perfect solution for you! However, as with any loan, there are certain qualifying requirements that you'll need to meet before you can secure the funds you need.

These requirements include having a solid credit score, providing proof of business income, and having a clear idea of how you plan to use the loan funds.

While these requirements might seem daunting, the benefits of an SBA loan, including low interest rates and flexible repayment terms, make it a valuable opportunity for any entrepreneur looking to take their business to the next level.

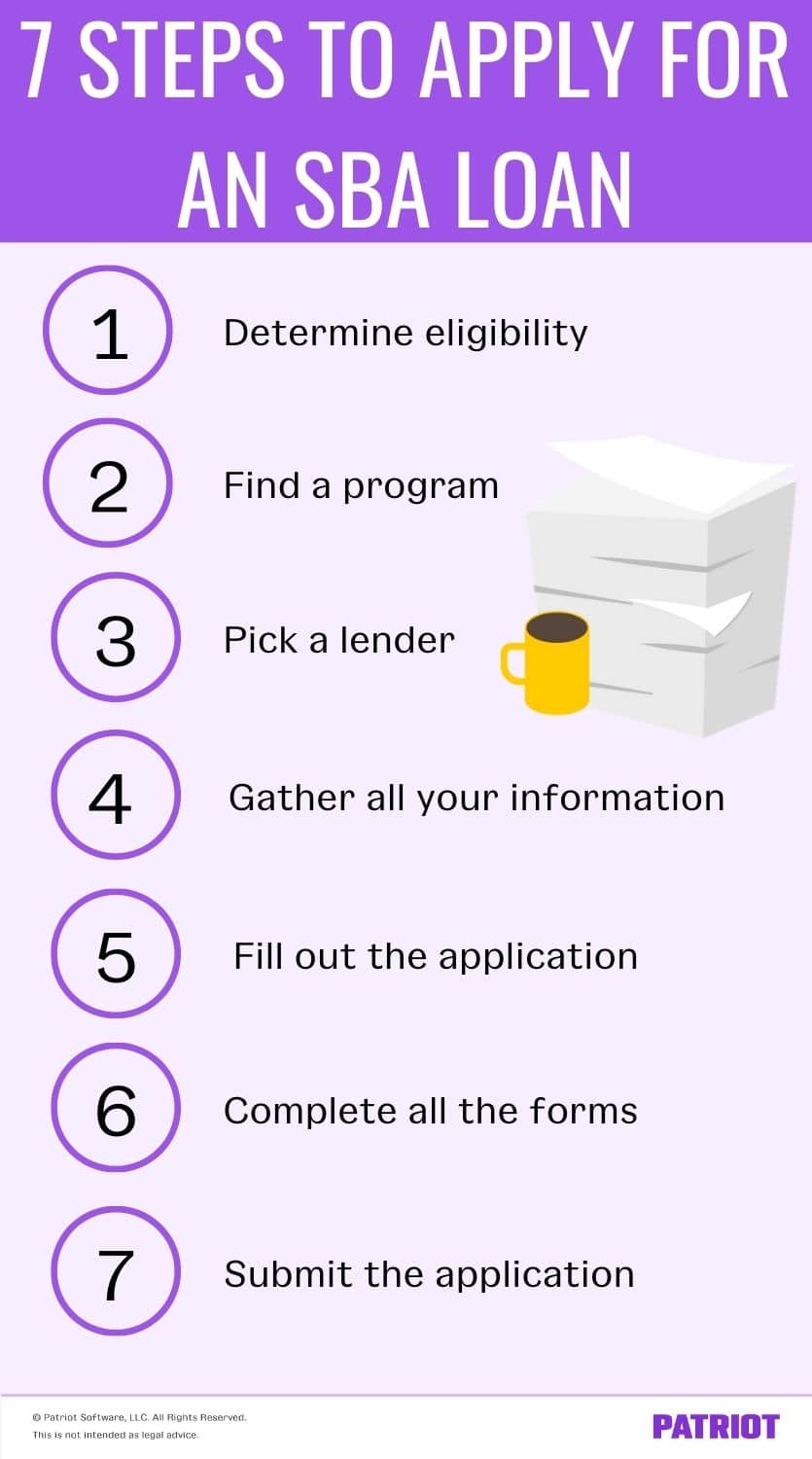

Steps to Take When Applying for an SBA Loan

Applying for an SBA loan can be a daunting process, but it doesn't have to be. With some careful planning and preparation, you can arm yourself with the knowledge you need to navigate the application process with confidence.

The first step is to gather all the necessary documentation, such as business and personal tax returns and financial statements. From there, you'll want to start identifying potential lenders and researching their requirements, as different SBA loan lenders may have different eligibility criteria.

Be sure to also brush up on your credit score and work on improving it, if necessary, as this can play a crucial role in securing a loan. Finally, it's important to have a solid business plan that details your goals, finances, and projected revenue. With these key steps in mind, you'll be well on your way to securing the SBA loan that's right for you.

How to Utilize the Funds from an SBA Loan

When starting a business or expanding an existing one, obtaining funding can be crucial. One potential source of financing is a Small Business Administration (SBA) loan. These loans offer low interest rates and flexible repayment terms, making them an attractive option for entrepreneurs.

Once you've received the funds, it's important to utilize them effectively to maximize the growth of your business. Some key ways to utilize an SBA loan include investing in marketing and advertising to increase visibility and attract new customers, expanding your product or service offerings, and upgrading equipment or technology to improve efficiency and productivity.

By investing wisely in your business, you can use the SBA loan to help you achieve your growth goals and take your business to the next level.

Common Mistakes to Avoid When Applying for an SBA Loan

Thinking of applying for an SBA loan? It's a great way for small businesses to access the financing they need to grow and thrive. However, there are some common mistakes that applicants make that can hurt their chances of getting approved.

For example, some businesses fail to properly research the types of loans available or don't understand the requirements for their specific industry. Others may not have their finances in order, causing lenders to question their ability to repay the loan.

By avoiding these mistakes and others like them, you can increase your chances of successfully securing an SBA loan and taking your business to the next level.

To sum it up, an SBA loan is a viable option for those looking to take their restaurant business to the next level. With a streamlined application process and lenient requirements, the SBA loan can offer businesses the cash flow they need to invest in potential growth opportunities.

Post Comment

Be the first to post comment!